Inflation hits highest peak in 30 years

Ever wondered what inflation means? Well Rebels Nina Egbutah takes a look at the historically high inflation experienced in the U.K. recently, and explains how it effects not just the economy but our every day lives…..

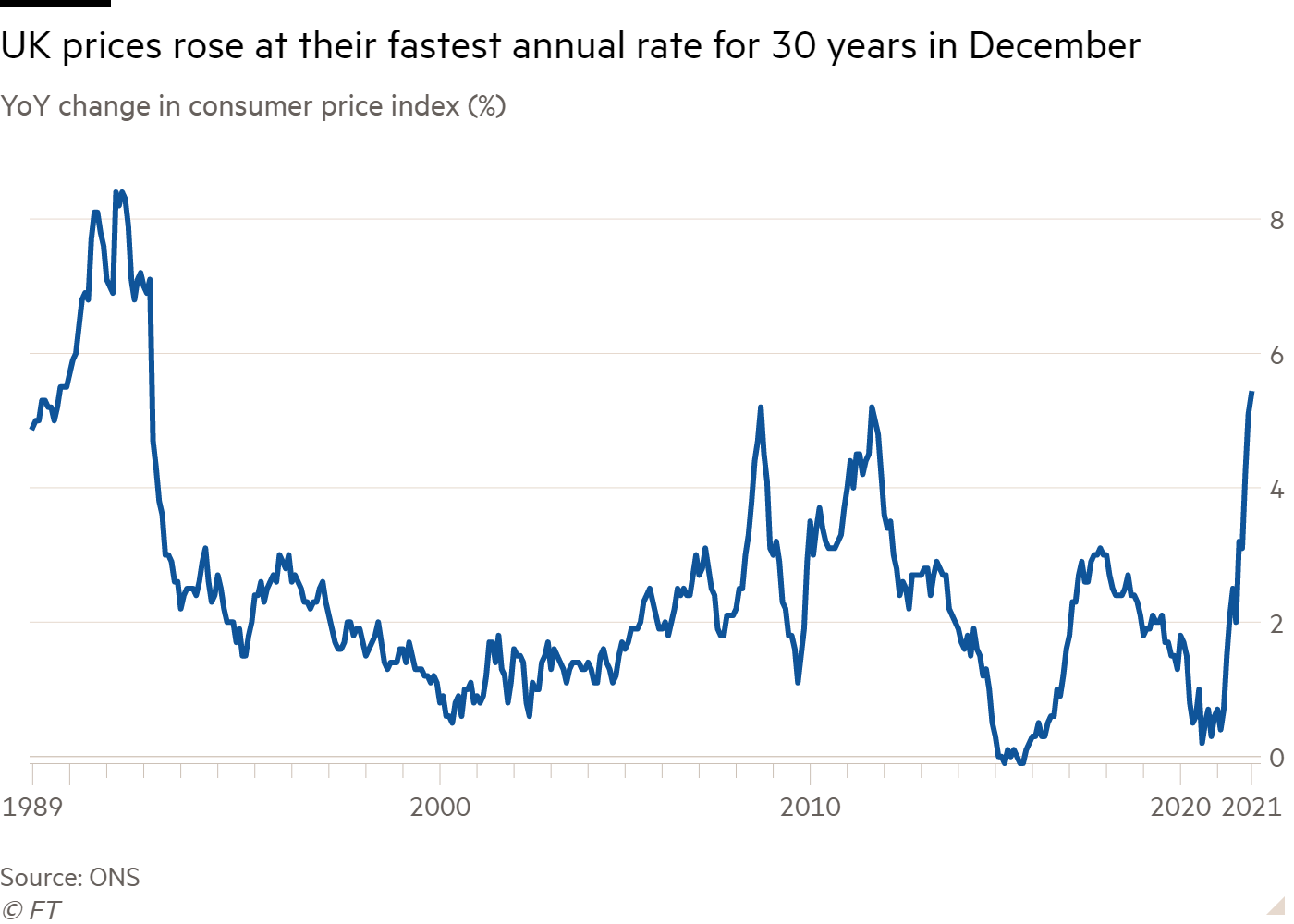

Inflation has hit its peak being the highest its been in 30 years. Britons have now experienced another traumatic fiscal event due to a surge in prices of necessary goods. This term is one of the most common words in the world of economics. But for those who have no knowledge of economics, what is it?

According to The Bank of England, inflation is the “term used to describe the increase in prices over time. How quickly those prices go up is called the rate of inflation.” Although it is typically a broad measure, analysing the augment in prices can also be acutely calculated for example; analysing certain goods.

Consumers’ cost of living depends on the price of many goods and services and the percentage it takes of their household budget. Government agencies undertake home surveys to establish routinely purchased commodities and then monitor the cost of purchasing the basket to determine the typical consumer’s cost of living.

This basket is then depicted relative to a base year making it the Consumer Price Index. For example, if the base year CPI is 100 and the current CPI is 138, then inflation is now 38 percent over the time period.

The ONS (Office of National Statistics) has stated that Consumer Prices Index Including Owner Occupiers’ Housing Costs (or better known as CPIH) rose by 4.8% percent in the year to December. This being the highest it’s ever been since September 2008, the year of the GFC.

The reason for why high inflation is so pernicious to the economy, thus british lives is because it results in the erosion of real income. The BoE has many economic targets to regulate the economy and make it feasible for Britons to comply with, one of them being low inflation. The target implemented is 2% however as of 4th January 2022, the inflation rate is 5.4%.

Resulting in the BoE coming face to face with a large dilemma as they did not anticipate a plight of high inflation. Households become worse off when their nominal income does not rise as quickly as prices, as it lowers their purchasing power. So with this specific situation, its been essential items that have been rising such as the rising global price of energy, catalysing more than 20 energy companies in the UK to collapse over December.

This has meant higher energy bills for businesses who can pass this unto to customers. However, it is not only energy, it is essential items such as food too.

So due to high inflation being prevalent in the UK, it results in Britons having less purchasing power, thus, a lower standard of living. The UK entering a crisis concerning living standards means that many people do not have reliable access to the resources necessary for day to day costs of a decent quality of life.

According to the New Economics Foundation, the four societal effects on a country having a low standard of living are:- Widespread deprivation: large numbers of people stuck in a cycle of poverty- Lack of cohesion: resulting in an increasingly segregated society- Macroeconomic stagnation: weak demand and productivity growth- Low economic resilience: greater exposure to instability and recession

COVID-19 ensued economic collapse but combined with the high inflation, the economy has witnessed things exacerbate over the past couple of years. This started with slow real economic growth causing limitations on spending habits.

This stereotypically helps keep the lower income families living standards low whilst expanding disparities throughout the UK population as a whole. However, as of late, the ONS has revealed how because petrol prices are now high, reaching 26.8% in December, the pace of inflation is now “similar” amongst the classes.

As a method of tackling the strain on consumers caused by high inflation, the Bank of England is expected to raise interest rates this week. This typically is the only way to tackle such an issue, by implementing a strong monetary policy to limit consumer spending.

By raising interest rates it will increase the cost of borrowing and reduce disposable income. This will affect both consumers and firms and temporarily be a painful time during the economy, however we can only hope that it is successful and one day we revert back to normal.