With the end of the second lockdown in the United Kingdom coming to an end tomorrow, Nina Egbutah looks into how it has impacted the national economy.

The reinstated ‘Stay Home Stay Safe’ has a high probability of demolishing any chance of recovery.

To terminate the pandemonium which is the spread of coronavirus, most countries undertook national restrictions in the first half of 2020 and Britain was no different. This implied closing non-essential businesses, non-essential activities and even physical educational establishments. Now with the initial shock of the pandemic declining rapidly, everything started to reverse. However, on 31st October 2020, Boris Johnson announced for another lockdown to commence. After 2nd December, restrictions would be alleviated and the tier system would be re-enacted.

Immediately after the Prime Minister warned of a new lockdown, Chancellor Rishi Sunak stated that the UK’s furlough scheme will be re-established, paying 80% of wages for the hours that employees were meant to work, grants for the businesses that have to close, and mortgage holidays. Presaging the second lockdown in England will have “significant additional impacts” on the UK economy. Implementing the furlough schemes averts unemployment taking place and the associated costs, such as: lost human capital and increased Government borrowing (due to a lack of income tax being placed in the economy), all while giving people a steady income which supplies a persistent augment to consumption, henceforward national income, aggregate demand and standard of living is continual.

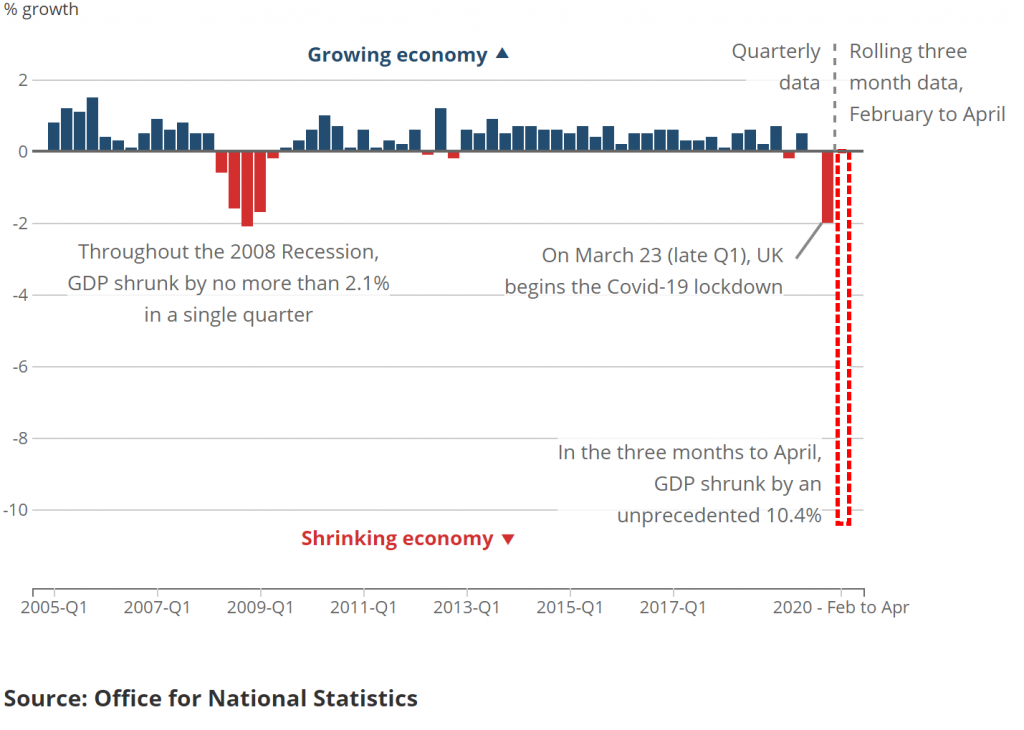

UK GDP growth, Quarter 1 (Jan to Mar) 2005 until June to August 2020

In the second quarter of 2020 (April to June), GDP shrunk by 19.8% and between February and April when the first lockdown was enacted, UK GDP shrunk 25%, compared to a measly 2.1% in the first quarter during 2008. This makes the coronavirus pandemic, accompanied with lockdown, the worst recession since the Global Financial Crisis of 2008. Lockdowns are seen as a pernicious temporary economic setback but a long-term benefit in terms of public health as it shields the general population from the contracting virus.

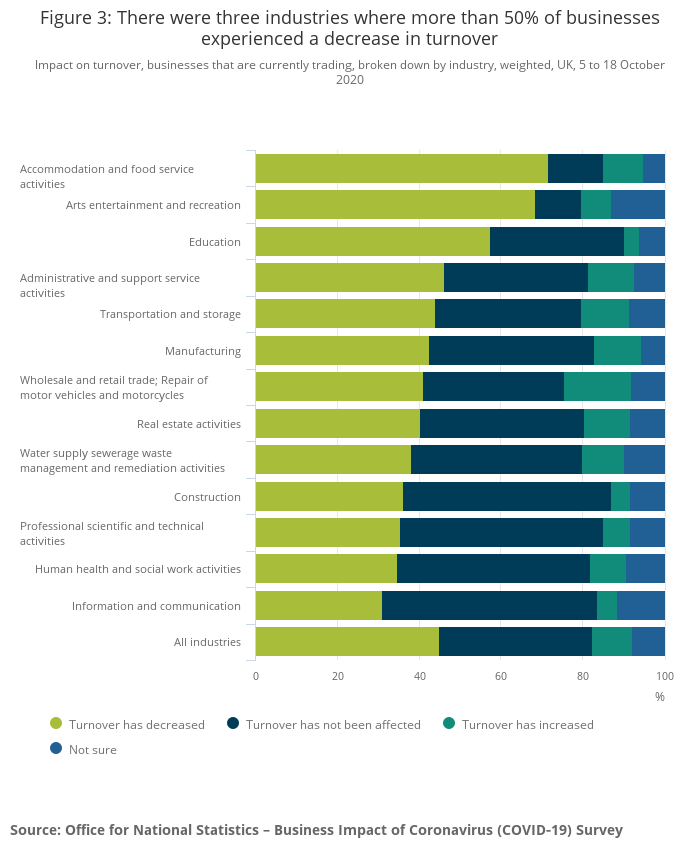

Across all industries, there were three of these where greater than 50% had a decrease in turnover. These were the accommodation and foodservice industry (72%); the arts, entertainment and recreation industry (69%); and the education industry (private sector and higher education businesses only) at 57%. Quarantine has also reduced the number of tourists available. Tourism generates £106 billion a year (VisitBritain), thus not only hindering money from entering the economy but reducing the number of jobs available to the UK public.

According to the Office for National Statistics (ONS), the recent unemployment rate was 4.8% (July to September) which also included an increase of 0.7% over the last three months; meaning that over 1.5 million people were unemployed. The Bank of England affirmed that unemployment could peak to 7.7% in April – June of 2021.

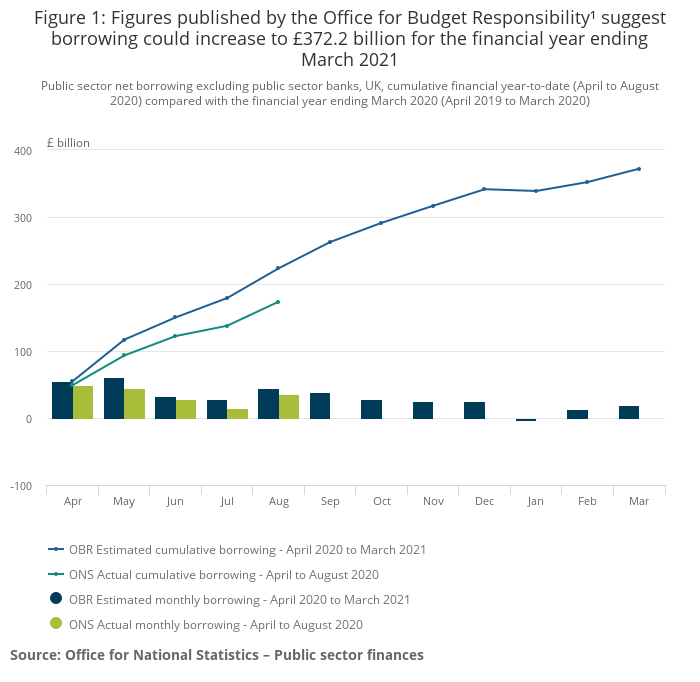

Public sector net borrowing excluding public sector banks, UK, (April to August 2020) compared with the financial year ending March 2020 (April 2019 to March 2020)

Government borrowing is also at an all-time high to fund the coronavirus relief policies, whilst many companies cut jobs as a precaution for the end of the furlough scheme making the number of redundancies from July to September: 181,000 (BBC) This will place the UK is a multitude of debt.

Britain is seen as a developed country, ranking 14th with a score of 0.922 (1.0 being the highest possible score) in 2020 in terms of HDI by the World Population Review (an index used to place countries based on their human development) it is expected to rebound quickly economically from lockdowns and its disparaging consequences. However, this is not the case. So, is Britain really as developed as perceived?

Unquestionably, coronavirus didn’t hurt the economy like the reparations of lockdown have. The Government faces a consistent opportunity cost, people’s lives or the economy. Even if lockdown was implemented earlier it would’ve merely shifted the economic impact outward not shortened it. The plunge from prosperity to peril was horrifying and the length of the economic impact lasts depends on how long the pandemic lasts. This depends on health policy choices utilised, but the attrition of the economy is unlikely to truncate.